Cash Loan Online: Quick Approval and Disbursement

When unexpected expenses arise, getting financial help fast can make all the difference. Online lending platforms have revolutionized how people access emergency funds, offering a lifeline during urgent situations like medical bills or car repairs. These digital services prioritize speed, often delivering approval decisions in hours instead of days.

Traditional bank applications often involve piles of paperwork and weeks of waiting. Modern solutions eliminate these hurdles with streamlined processes you can complete from home. Digital verification cuts down on delays, letting you focus on what matters—resolving your financial needs without stress.

Whether you’re covering a sudden expense or bridging a temporary gap, these services provide flexibility. Many platforms transfer money directly to your account within 24 hours of approval. This guide will explain how to navigate your options confidently and secure the support you need efficiently.

Key Takeaways

- Online platforms deliver faster approval times than traditional banks.

- Digital applications reduce paperwork and simplify verification.

- Funds often arrive within one business day after approval.

- Emergency expenses like medical bills or repairs are common use cases.

- Understanding loan terms helps borrowers make informed decisions.

Overview of Online Cash Loans

In today’s fast-paced world, obtaining funds without collateral is easier than ever through online services. These financial products, often called personal loans, let you borrow money for anything from medical bills to home upgrades. No need to risk your car or house—approval depends on factors like income and credit history.

Digital platforms have changed how we access credit. Instead of waiting in bank lines, you can compare rates and terms from lenders nationwide in minutes. “The average borrower saves 35% on interest by shopping online first,” notes a recent financial study. Companies like LendingClub streamline the process, connecting users with over $90 billion in funded loans since 2007.

Here’s why these solutions stand out:

- Flexible use: Pay off high-rate debts or handle emergencies

- Speed: Many applications get same-day decisions

- Transparency: Clear terms without hidden fees

Whether you’re consolidating debt or financing a project, online options adapt to your needs. Funds typically arrive within 24 hours, making them ideal for urgent situations. Just ensure you understand repayment timelines and compare multiple offers before committing.

Understanding the Cash Loan Process

Getting the funds you need starts with a straightforward online form. You’ll share basic details like income, employment status, and desired amount. This step usually takes under 10 minutes—no paperwork or branch visits required.

Most lenders begin with a soft credit check to estimate your rates. Unlike hard inquiries, this doesn’t affect your credit score. Platforms like LendingClub use this method to show personalized offers while keeping your report intact. You can compare multiple options risk-free.

Here’s how credit checks work at different stages:

| Stage | Check Type | Impact on Credit |

|---|---|---|

| Rate Comparison | Soft Inquiry | No Effect |

| Final Approval | Hard Inquiry | Temporary Dip (2-5 points) |

After choosing an offer, lenders verify your information through a hard pull. Automated systems then review your application, often delivering decisions within hours. Funds typically arrive next business day if approved.

This approach lets you shop confidently. Since initial checks don’t lower your score, you can explore rates from various providers. Always review terms carefully before accepting any agreement.

Quick Approval and Disbursement Explained

Digital lenders prioritize speed when you need urgent financial support. Their systems analyze your eligibility in real time, focusing on key factors that determine how quickly you’ll receive funds. Let’s break down what accelerates approvals and how timing works for different situations.

What Gets You Approved Instantly

Lenders look for three main traits: steady income, reliable credit history, and accurate application details. Automated tools verify employment and bank data within minutes. “A clean application with no discrepancies cuts approval time by 75%,” says a fintech industry report. Platforms like ACE Cash Express use this approach to deliver decisions in under 10 minutes.

When You’ll Receive the Money

Timing depends on your bank and application quality. Most lenders send funds electronically—ACE deposits can arrive in 30 minutes if your bank supports instant transfers. Discover processes error-free weekday requests by the next business day. Delays happen if applications need extra checks or get submitted during weekends.

Key conditions affecting speed:

- Bank partnerships: Institutions with direct payment networks move money faster

- Verification: Complete pay stubs or tax forms prevent follow-up questions

- Transfer method: Direct deposits beat paper checks by 1-3 days

For emergencies, many services flag urgent cases to expedite reviews. Always double-check your application details to avoid holdups when time matters most.

Loan Amounts, Terms, and Payment Options

Flexibility defines modern borrowing experiences. Lenders like Discover and LendingClub let you choose how much you need and how long to repay it. This customization helps match your financial situation while keeping costs manageable.

Understanding Loan Terms

Loan amounts vary widely across providers. For instance, Discover offers up to $40,000, while LendingClub extends limits to $50,000. Repayment periods typically span three to seven years, giving you control over your budget. “Longer terms mean smaller monthly payments but higher overall interest,” explains a financial advisor from NerdWallet.

Monthly Payment Calculations

Your payment depends on three factors: the amount borrowed, interest rate, and term length. A $20,000 loan at 8.99% APR over five years costs $415 monthly. Over 60 months, you’d pay $24,900 total. Shorter terms save money long-term but require higher monthly commitments.

Most lenders use fixed rates for predictable budgeting. This means your payment stays identical each month. Always compare offers—even a 1% rate difference could save thousands over several years.

Eligibility, Credit Score, and Application Requirements

Understanding what lenders look for helps you prepare a stronger application. Most digital financial services have straightforward requirements, but your credit history and current situation play significant roles. Let’s explore the key factors that determine approval and how they affect your options.

Eligibility Criteria

To qualify, you’ll need a valid Social Security Number and proof of U.S. residency. Providers typically require applicants to be at least 18 years old with a minimum individual or household income of $25,000 annually. This ensures you can manage repayment alongside other expenses.

A physical address and active email are mandatory for identity verification. Digital access through a smartphone or computer is also essential since applications happen online. These basic requirements help lenders confirm your identity while maintaining security.

Impact of Credit History

Your credit score influences both approval odds and interest rates. While some services work with fair scores, higher ratings often secure better terms. “Borrowers with scores above 720 save 22% on average compared to those below 650,” reports Experian’s 2023 analysis.

Lenders review payment patterns and credit utilization ratios too. Multiple recent applications might raise concerns about financial strain. Maintaining older accounts shows stability, while low balances relative to limits demonstrate responsible usage.

By understanding these factors, you can position yourself for success. Always double-check your application information to avoid delays—accurate details speed up verification and funding.

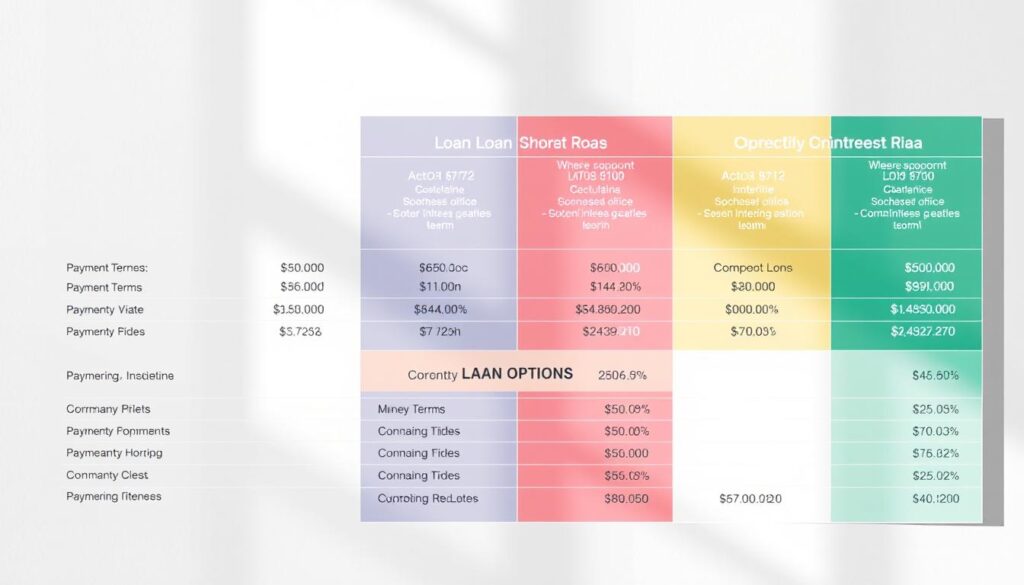

Comparing Cash Loans with Personal Loans and Other Credit Options

Understanding different financial tools helps you make smarter decisions. Credit cards and personal loans serve distinct purposes, each with unique benefits. Let’s explore how these options stack up for various needs.

Why Personal Loans Shine

Personal loans often beat credit cards for larger expenses. They lock in fixed rates, so your payment stays predictable. Discover offers rates starting at 7.99% APR with no fees—a sharp contrast to cards averaging 20%+ interest.

| Lender | APR Range | Fees |

|---|---|---|

| Discover | 7.99%-24.99% | None |

| Citibank | 11.49%-20.49% | 1-5% origination |

| SoFi | 8.99%-29.49% | Variable |

Fixed repayment terms clear debt faster than revolving balances. You’ll know exactly when you’ll be debt-free—no endless minimum payments.

Opting for Emergency Funding

Credit cards work best for small, short-term purchases. Need $500 for car repairs? A card makes sense if you can pay it off quickly. But for bigger needs like medical bills, personal loans provide structured repayment plans.

Key considerations:

- Cards offer flexibility but risk interest snowballs

- Fixed-rate loans protect against rate hikes

- Fee-free lenders like Discover save upfront costs

Match your choice to the expense size and timeline. Structured payments from personal loans prevent debt drag, while cards handle immediate smaller needs. Your financial goals should guide this decision.

Tips for Debt Consolidation and Financial Management

Juggling multiple payments each month? Combining debts through debt consolidation could simplify your financial life. This strategy lets you merge credit card balances, medical bills, and other obligations into one manageable payment. Many find it easier to track progress with a single due date and fixed interest rate.

Before consolidating, crunch the numbers. Compare your current interest rates with potential offers. “A 5% rate difference on $15,000 could save $1,800 over three years,” shares a NerdWallet analyst. Always factor in origination fees and repayment timelines to ensure true savings.

Use this opportunity to reset spending habits. Create a budget that accounts for your new payment while leaving room for emergencies. Building a safety net helps avoid relying on cards again when unexpected expenses arise.

Strategic uses for consolidation loans include:

- Home renovations that boost property value

- Emergency medical treatments or fertility care

- High-interest credit card balances

Many borrowers report lower stress levels after simplifying their payments. With fewer due dates to track, you can focus on long-term goals like saving for vacations or education. Just remember—consolidation works best when paired with disciplined financial habits.

How to Apply for Your Online Cash Loan

Starting your application from home takes just minutes. Modern platforms prioritize user-friendly processes, letting you complete everything digitally. This eliminates trips to physical locations while maintaining security through encrypted systems.

Step-by-Step Application Process

First, fill out the online form with personal and financial details. Most systems auto-save progress, letting you pause if needed.

Next, review offers after lenders perform soft credit checks. These preliminary assessments don’t affect your credit score.

Finally, submit verification documents like pay stubs electronically. Approval decisions often arrive within hours for complete submissions.

Post-Approval Funding Process

Once approved, funds typically reach your account within one business day. Many services offer instant transfers through partner banks, while others use standard ACH deposits.

Some lenders charge origination fees deducted upfront, reducing the deposited amount. Review your agreement carefully—transparent providers clearly outline these costs before you accept funds.

Always double-check your banking information to prevent delays. Electronic transfers remain the fastest method, avoiding paper check mailing times.